MMT

지은이: Mary Mellor날짜: 2012년 7월 (추정)

자료: PPT-style PDF

※ 발췌 (excerpt):

References

- John Kenneth Galbraith (1975), Money: Whence it came and Where it went, Penguin

- David Graeber (2011), Debt: The First 5000 Years

- Hanlon, Joseph, Armando Barrientos and David Hulme (2010), Just Give Money to the Pooer, Kumarian Press

- Geoffrey Ingham (2004), The Nature of Money, Macmillan

- L. Randall Wray (2004), Credit and State Theories of Money, Edward Elgar

Further Reading

- Mary Mellor (2010), The Future of Money: From Financial Crisis to Public Resource, Pluto

- Mary Mellor (1020), "Could the money system be the basis of a sufficiency economy?", Real-world economic review, 54

- Frances Hutchinson, Mary Mellor, Wendy Olson (2002), The Politics of Money, Pluto

- Josh Ryan-Collins et al (2011), Where Does Money Come From? New Economics Foundation

* * *

( ... )Without borrowing and lending would we have a society or an economy?

Looking at debt differently:

- Debt as reciprocityㅡsocial obligation, social linkages.

- Debt as reparationㅡfines, injury payment

- Debt as obligationㅡtaxation, tithes

- Debt as enabling trade

- Debt issue as money supply

- Debt itself as credit-debt

Misunderstanding money

- The misleading gold story: precious metal money as emerging from barter

- Paper seen as replaceing metal coin leading to inflating, unsustainable money systems

- Call for a return to a 'gold standard' or similar 'har' 'sound' money

- Misrepresents the history and nature of money

Understanding money

- Money has taken many forms: hieroglyphs, clay tablets, tally sticks, paper, electronic

- Money and banking systems MUCH OLDER THAN precious metal coinage (C7th BCE)

- Early bankingㅡaccounting and transfer of assets (grain storage)

- Social mechanism for tribute, reparations (e.g. injury), marriage obligations etc

- No evidence of widespread barter

- Precious metal coins were too valuable for most purposes (unless debased)

- Commodity basis of precious metal coinage confuses its money function

- Function of money is not to embody actual value (commodity as medium of exchange) but to record relative values of ownership, obligations and transfers (Ingham 2004)

Money as a credit-debt token

- All money is a token, a record of an obligation (debt) and a promise (credit): ' I promise to pay ' ...

- Even gold/silver coins are only tokensㅡalthough gold/silver can be sold as a commodity

- Money is a ‘credit’ for future expenditureㅡtherefore a ‘debt’ on society

- Money only works if people trust itㅡthat they will get goods and services in exchange for it

Social basis of money

- Money functions WITHIN a money system

- Money systems can be based on trust (social convention) or some form of authority (fiat)

- The face value of money (whatever form) is set by social convention or an authority

- Money systems can collapse if trust/authority is lostㅡthey are social/political systems as much as economic systems

Money as Debt

- Money as representing social obligations

- Money as representing authority and public, civic obligationsㅡdebt of people to the rule/authority and vice versa

- Money as representing economic obligations: based on formal or informal contractsㅡbond(age)

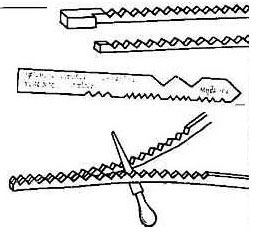

Debt-money: tally sticks

- Tally sticks are more useful to understanding money than the precious metal story

- 'from time immemorial, scored or notched wooden sticks have been used ... for ... recording payments' (Glyn Davies, A History of Money 2002: 148)

- Used in trade and for state expenditure and revenue in Britain until 1820s

- Accumulated sticks burned down Parliament in 1834

CF. tally stick

CF. tally sticks

CF. The Day Parliament Burned Down (amazon book info)

CF. Come on Mr. Tally Man

Tally sticks

- Notched sticks split longwaysㅡcreditor takes stock/stub and the debtor the counterfoil

- Creditors can use the stock/stub to buy goods and services or pay taxes

- Debtors can hand on the counterfoil to others instead of taking payment

- Tally sticks are cancelled when the two parts are reunited. The debt is then cleared and the sticks destroyed

- Non-intrinsic money more prevalent than coin: 1698 coin=£11.6m: Tally sticks, bank notes, trade bills=£15.0m (Davies 2002)

- Discount houses bought stubs at less than face value or lend money by replacing lower value foils with higher value ones

- The treasury and discount houses acted as clearing houses squaring off payments between the crown, taxpayers and tradersㅡfew further debts/payments needed to settle balances

Debt and money issue

- Money does not appear fully formed in society

- It has to be originated (issued)

- People-issued money: records of deposits, loans, trades, obligations (social trust/bond-age)

- Fiat-issued money: tax obligations to rulers, rulers payment for goods and services (power)

- Bank-issued money [:] 'original debt'ㅡembodying as well as representing debt (bank bond-age)

Fiat money and taxation

- Taxation is central to the circulation of fiat money

- People accept fiat money as payment for goods and services because they need to access that money to pay their taxes (Knapp 1924, Wray 2004)

- Where fiat money is also the sole authorized mechanism of general economic exchangeㅡthe money issuer must not claim as tax all the money issued (i.e. must run a monetary deficit)

Lessons for the crisis

- Sole-authorized money systems need a substantial issue of money that is not reclaimed as debt or taxed to enable monetary circulation

- Money systems are not household where the issue point of money is external (handbag economics)

- Money systems are baby-sitting circles with internal issue of money (tokens)

- Fiat issued money is debt free at the point of issue (e.g. quantitative easing)

- Bank-issued money is 100% debt+interest

- Taxation in a fiat money system is never 100%

- Taxation can be a monetary as well as a fiscal instrument: it can prevent inflation by removing surplus money that is not matched by goods and services

State lose control: fiat to bank

State lose control: tax to debt

- Fiat money issue depends on state/ruler capactity to enforce the taxation circuit or get people to take the fiat money in payment

- Precious metal coinage seemed to solve the latter problem, but depended on supply of precious metal (led to mercantilism, war, piracy)

- Commodity-based coins also leaked from the money system (based on commodity value)

State lose control: tax to debt

- Where states/rulers spent beyond their capacity to raise taxes or get their money/credit accepted, the obligation of payment to states/rulers became replaced by extensive state/ruler borrowing from the banks/merchant class

- State fiat money became replaced by sovereign/national debt to the modern banking system (Graeber 2011)

- The Bank of England (a private company until 1946) lent £1.2 millin to the King in 1694 to be repaid by Parliament not the King

( ... )

Private moneyㅡstate debt

Bank-issued money: original debt

Private moneyㅡstate debt

- State money and trade money came together in the modern banking system when the commercial bank paper system became authorised as legal tender through the invention of bank notes that could circulate as cash guaranteed by the state 'I promise to pay'

- Most money is now intangible as ‘sight accounts’ (97%)ㅡbut underpinned by state

Bank-issued money: original debt

- 'the process by which banks create money is so simple that the mind is repelled' (Galbraith 1975: 29)

- Where states no longer issue fiat moneyㅡnew money can only be created through bank loans

- Banks do not create new money by intermediating between depositors and borrowersㅡthis would not create new money

- New money must be continually created as existing loans are repaidㅡwith interest

- New money is created by setting up a deposit account for the borrowerㅡthis money gets trasnferred to other deposit accounts and seems to be 'real' debt free money

- Banks are supposed to lend in ratio to their capital assets and central bank reservesㅡbut this is hard to control in practice

- Jane d'Arista calculated the US reserve ratio at the height of the boom as 0.1%ㅡbut only a reserve of 100% is adequate if there is a run

- All bank issued money therefore carries two levels of debt: generalised social/public/economic credit-debt obligations and an original debt to the issuing bank

- Social/state/fiat money does not require repayment to the issuer as a condition of its issue (but tax and/or repayments may be demandedㅡe.g. returning baby sitting tokens on leaving the system)

Original debt as money supply

- Nearly all money in circulation today has been issued as debt through the banking system

- Money supply therefore depends solely on debt demand (from people/ businesses/ governments) and bank willingness to lend

- In the run up to the crisis UK money supply was growing rapidly (up to 17% a quarter)

- After the crisis fell rapidly as debts were repaid (8% a quarter)

Privatisation of money issue

The contradiction of original debt

- Ideological hegemonyㅡnew money can only be issued through the banking system as loans

- States must not 'print' debt free moneyㅡcertainly not for public expenditure

- But OK to 'quantitatively ease' the banks

- Even social policy based on debt (microcredit) creates huge inequalities depending on who is judged to be 'creditworthy'

The contradiction of original debt

- Debt embodied money issue demands constant money supply growth to repay debts with interest

- Without such growth money supply will rapidly shrink as debts are repaid

- Vast increase in money supply has created inflated asset prices and unsustainable levels of debtsㅡmainly for households and the financial sector

Undermining the public

Public responsibility

The Money System is not Private

Public responsibility without power

Debt cannot fund a money system

Summary: The Public Nature of Money

Money as a Public Resource

- The public sector is seen as dependent on the private 'money creating' sector (sic)ㅡyet in the crisis it has underpinned it

- All forms of money are based on legal tender which the state effectively underwites

- States and monetary authorities support to financial sector at least $15 trillion worldwide

- Countries bankrupted: Iceland financial sector 10×GDP; In UK RBS alone=GDP

Public responsibility

- It is impossible to distinguish different types of moneyㅡthere is no 'real' money

- In a systemic crisis the whole money system must be supported (Lehman Brothers)

- State responsibility for the integrity of its national money means it has to continually bail out the privatised money system

- Major problem if borrowings are in another currency or money issue is externally controlled (e.g. euroㅡplus ECB has very limited remit)

The Money System is not Private

- The public clearly sees states/authorities as responsible for the whole banking system: Northern Rock, Icesave, Iceland, eurozone, IMF

- States now have to take on 'sovereign debt' to rescue private debtㅡironically borrowed from the self-same banks and 'money markets'

- States/households are even seen as responsible for the avalanche of debtㅡhence austerity

Public responsibility without power

- State is denied its original money issue role by 'handbag economics' which sees the state as a household without money creating powers

- States are dependent on the 'money markets' (i.e. financial sector) if they cannot raise sufficient taxes (deficit)

- Arbitrary 'rules' are developed on how much a state can borrow (Maastricht)

Debt cannot fund a money system

- There is a distinction between money as a token representing debts between citizens and money issue based on original debt

- Somewhere in the system money must be issued that is not reclaimed by the issuer otherwise the system only has two positions: growth or crisis

- People will be burdened with unnecessary debt until the role of privatised original debt in money issue is understood

Summary: The Public Nature of Money

- The financial system is not private

- It administers a public resourceㅡmoney as legal tender

- Its final resource is the taxation/money issue capacity of states

- Money is a social constructㅡa system of trust in debt-credit relations within a money system supported by public authority

- If that trust is destroyed it cannot easily be rebuilt

Money as a Public Resource

- Money should be seen as a 'commons'ㅡa social resource in the same way as air or water can be seen as a natural resource

- Need to reclaim money as a debt-free public resource with democratically determined priorities

- Money could be issued through public expenditure, public/social/commercial investment to provide goods and services, as a citizen's income and to alleviate poverty (Hanlon 2010)

- Money issue and banking should be a public service under democratic control

- We can then concentrate on removing all the other inequalities associated with debtㅡso that we are left with money as representing credit-debt solidaristic social obligations

- This could enable the creation of a socially just, sufficiency economy

댓글 없음:

댓글 쓰기