(1) A measure of performance on a risk-adjusted basis. Alpha takes the volatility (price risk) of a mutual fund and compares its risk-adjusted performance to a benchmark index. The excess return of the fund relative to the return of the benchmark index is a fund's alpha.

(2) The abnormal rate of return on a security or portfolio in excess of what would be predicted by an equilibrium model like the capital asset pricing model (CAPM).

Investopedia explains 'Alpha'

(1) Alpha is one of five technical risk ratios; the others are beta, standard deviation, R-squared, and the Sharpe ratio. These are all statistical measurements used in modern portfolio theory (MPT). All of these indicators are intended to help investors determine the risk-reward profile of a mutual fund. Simply stated, alpha is often considered to represent the value that a portfolio manager adds to or subtracts from a fund's return.A positive alpha of 1.0 means the fund has outperformed its benchmark index by 1%. Correspondingly, a similar negative alpha would indicate an underperformance of 1%.(2) If a CAPM analysis estimates that a portfolio should earn 10% based on the risk of the portfolio but the portfolio actually earns 15%, the portfolio's alpha would be 5%. This 5% is the excess return over what was predicted in the CAPM model.

자료 2: Wikipedia (as of Apr 21, 2014)

Alpha is a risk-adjusted measure of the so-called active return on an investment. It is the return in excess of the compensation for the risk borne, and thus commonly used to assess active managers' performances. Often, the return of a benchmark is subtracted in order to consider relative performance, which yields Jensen's alpha.

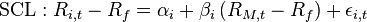

The alpha coefficient () is a parameter in the Capital Asset Pricing Model (CAPM). It is the intercept of the security characteristic line (SCL), that is, the coefficient of the constant in a market model regression.

It can be shown that in an efficient market, the expected value of the alpha coefficient is zero. Therefore the alpha coefficient indicates how an investment has performed after accounting for the risk it involved:

: the investment has earned too little for its risk (or, was too risky for the return)

: the investment has earned a return adequate for the risk taken

: the investment has a return in excess of the reward for the assumed risk

자료 3: 투자 수익의 알파와 베타

( ... ) 이러한 수익률 평가에서 적용되는 개념이 수익의 ‘알파’와 ‘베타’이다. ‘알파’란 실제 수익률과 비교 지수와의 수익률 차이를 나타내며, ‘베타’란 시장 상황에 노출되어 있는, 즉 전체 지수의 움직임에 편승하여 얻은 수익률을 나타낸다. 예를 들어 S&P 500 지수가 10% 상승한 기간 동안, A 라는 사람의 포트폴리오는 15% 올랐고 B 라는 사람의 포트폴리오는 12% 밖에 오르지 못했다고 하자. 두 사람의 본래 투자목표가 S&P 500 지수 보다 높은 수익률을 내는 것이었다고 가정하면, A 의 ‘알파’는 5% (15% - 10%), B 의 ‘알파’는 2% (15% - 10%)가 된다. 이러한 ‘알파’의 비교는 자산 운용의 실적을 평가하는 중요한 기준의 하나이다. ‘베타’는 운용자의 능력과 상관없이 시장에서 자동적으로 주어지는 것이므로, ‘알파’가 차지하는 부분이 전체 수익과 대비하여 높을수록 펀드 매니저 또는 투자자의 수익 창출 능력이 높은 것이다. ( ... )

자료 4: 자기자본이익률, 베타, 알파

The search for alpha (risk-adjusted return) has been the central question in the hedge fund industry, and the debate about the existence of alpha is an important topic in academic research on hedge funds. ( ... )

댓글 없음:

댓글 쓰기