기타 참고 1: Investopedia on Private Equity:(...) Private equity firms will sometimes pool funds together to take very large public companies private. Many private equity firms conduct what are known as leveraged buyouts (LBOs), where large amounts of debt are issued to fund a large purchase. Private equity firms will then try to improve the financial results and prospects of the company in the hope of reselling the company to another firm or cashing out via an IPO.기타 참고 2: Private Equity Firm들은 요즘 어떻게 지내나?

A private equity firm is an investment manager that makes investments in the private equity of operating companies through a variety of loosely affiliated investment strategies including leveraged buyout, venture capital, and growth capital. Often described as a financial sponsor, each firm will raise funds that will be invested in accordance with one or more specific investment strategies.

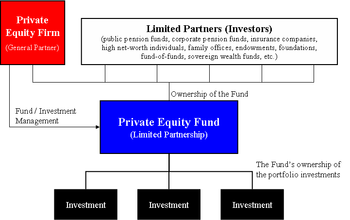

Typically, a private equity firm will raise pools of capital, or private equity funds that supply the equity contributions for these transactions. Private equity firms will receive a periodic management fee as well as a share in the profits earned (carried interest) from each private equity fund managed.

Private equity firms, with their investors, will acquire a controlling or substantial minority position in a company and then look to maximize the value of that investment. Private equity firms generally receive a return on their investments through one of the following avenues:

- an Initial Public Offering (IPO) - shares of the company are offered to the public, typically providing a partial immediate realization to the financial sponsor as well as a public market into which it can later sell additional shares;

- a merger or acquisition - the company is sold for either cash or shares in another company;

- a Recapitalization - cash is distributed to the shareholders (in this case the financial sponsor and its private equity funds either from cash flow generated by the company or through raising debt or other securities to fund the distribution.

Contents[hide] |

[edit]Ranking private equity firms

According to an updated 2008 ranking created by industry magazine Private Equity International[1] (The PEI 50), the largest private equity firms include The Carlyle Group, Kohlberg Kravis Roberts, Goldman Sachs Principal Investment Group, The Blackstone Group, Bain Capital and TPG Capital. These firms are typically direct investors in companies rather than investors in the private equity asset class and for the most part the largest private equity investment firms focused primarily on leveraged buyouts rather than venture capital.

Preqin ltd (formerly known as Private Equity Intelligence), an independent data providers provides a ranking of the 25 largest private equity investment managers. Among the largest firms in that ranking were AlpInvest Partners, AXA Private Equity, AIG Investments,Goldman Sachs Private Equity Group and Pantheon Ventures.

Because private equity firms are continuously in the process of raising, investing and distributing their private equity funds, capital raised can often be the easiest to measure. Other metrics can include the total value of companies purchased by a firm or an estimate of the size of a firm's active portfolio plus capital available for new investments. As with any list that focuses on size, the list does not provide any indication as to relative investment performance of these funds or managers.

[edit]Private equity firms and private equity funds: an Illustration

The following is an illustration of the difference between a private equity firm and a private equity fund:

Private Equity Firm | Private Equity Fund | Private Equity Portfolio Investments (Partial List) |

Kohlberg Kravis Roberts & Co. (KKR) | KKR 2006 Fund, L.P. | |

[edit]See also

- Private equity

- Private equity fund

- List of private equity firms

- Leveraged buyout

- Management buyout

- History of private equity and venture capital

[edit]References

| This article includes a list of references, related reading or external links, but its sources remain unclear because it lacks inline citations. Please improve this article by introducing more precise citations where appropriate. (April 2009) |

- Private equity – a guide for pension fund trustees. Pensions Investment Research Consultants (PIRC) for the Trades Union Congress.

- Krüger Andersen, Thomas. Legal Structure of Private Equity Funds. Private Equity and Hedge Funds 2007.

- Prowse, Stephen D. The Economics of the Private Equity Market. Federal Reserve Bank of Dallas, 1998.

Private Equity Firms - PrivateEquityFirms.com, public directory of investment groups.

댓글 없음:

댓글 쓰기